14 Sep Does Your Financial Future Depend on HSA Savings?

In today’s fast-paced world, planning for a secure financial future has become a paramount concern for individuals and families alike. With the rising costs of healthcare, it’s crucial to explore all available avenues for safeguarding your finances. One such avenue that often goes overlooked is the Health Savings Account (HSA). In this article, we will delve deep into the world of HSA savings and explore whether your financial future truly depends on it.

What is an HSA, and How Does it Work?

Before we dive into the implications of HSA savings, it’s essential to understand what an HSA is and how it operates. An HSA is a tax-advantaged savings account specifically designed for medical expenses. It allows individuals to contribute pre-tax dollars into the account, which can then be used to cover qualified medical expenses. It’s crucial to monitor your healthcare expenses, which include doctor’s appointments, prescription drugs, dental care, and vision care. This is especially important if you have a Health Savings Account (HSA). With an HSA, you can save money tax-free to cover qualified medical expenses. But, if i accidentally used my hsa card for groceries, you might incur tax penalties and fees. Make sure to review your HSA transactions periodically and only use the funds for eligible healthcare expenses.

The Tax Advantages of HSA Contributions

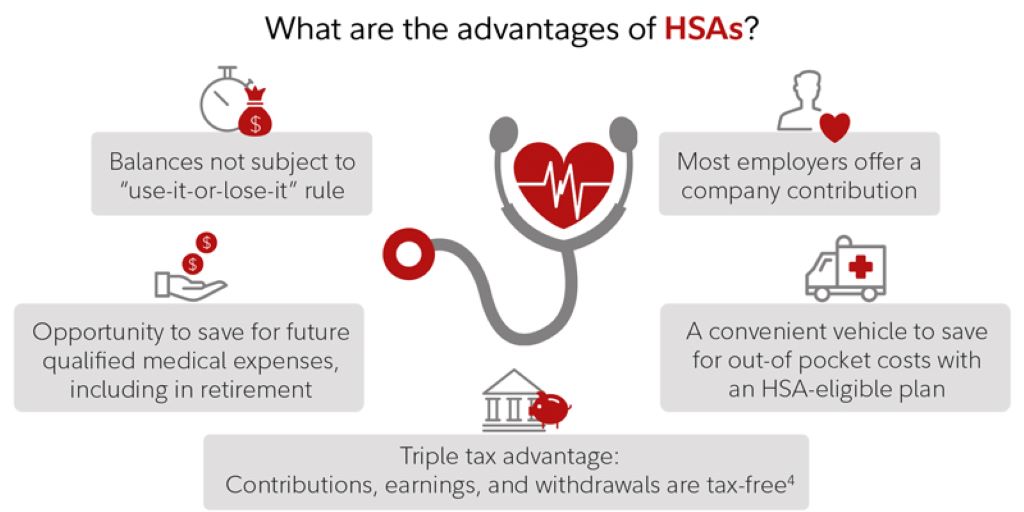

One of the primary attractions of HSAs is their tax benefits. Contributions made to an HSA are tax-deductible, meaning they reduce your taxable income for the year. This tax advantage can translate into substantial savings, especially for individuals in higher tax brackets.

The Role of HSA in Your Financial Future

Now that we’ve established what an HSA is let’s explore its significance in shaping your financial future.

1. Building a Healthcare Nest Egg

An HSA can serve as a valuable tool for building a nest egg specifically earmarked for healthcare expenses. By contributing regularly to your HSA, you’re essentially creating a financial safety net that can help you cover medical costs in the future without depleting your savings or retirement funds.

2. Mitigating Rising Healthcare Costs

The cost of healthcare is on the rise, and it’s showing no signs of slowing down. Having an HSA can help you mitigate the impact of these increasing expenses. With the funds in your HSA, you can address unexpected medical bills without resorting to high-interest loans or credit card debt.

3. Tax-Efficient Savings and Withdrawals

As mentioned earlier, contributions to your HSA are tax-deductible. Additionally, withdrawals from your HSA are tax-free when used for qualified medical expenses. This unique tax advantage makes HSAs a powerful tool for growing your savings while minimizing tax liability.

Is an HSA Right for You?

While HSAs offer numerous advantages, it’s essential to consider whether they are the right financial instrument for your unique situation.

1. Eligibility Requirements

To open and contribute to an HSA, you must have a high-deductible health insurance plan (HDHP). Ensure you meet the eligibility criteria before diving into HSA savings.

2. Risk Tolerance

Like any investment, there are risks associated with HSAs. The funds in your HSA can be invested, which means they are subject to market fluctuations. Consider your risk tolerance and investment strategy when utilizing an HSA for long-term savings.

3. Healthcare Needs

Assess your current and anticipated healthcare needs. If you have minimal healthcare expenses or comprehensive coverage through your employer, an HSA may not be as beneficial.

In conclusion, the question of whether your financial future depends on HSA savings is nuanced. HSAs offer a range of advantages, including tax benefits and the ability to build a dedicated healthcare fund. However, their suitability depends on your unique circumstances and financial goals. It’s essential to consult with a financial advisor to determine whether an HSA aligns with your long-term financial plan.

FAQs

- How much can I contribute to my HSA annually?

The annual contribution limit for an HSA varies each year. In 2023, for individuals, it’s $3,650, and for families, it’s $7,300.

- Can I use HSA funds for non-medical expenses?

Yes, you can, but non-medical withdrawals are subject to income tax and a 20% penalty if you’re under 65. After 65, you can use HSA funds for non-medical expenses without the penalty, but income tax still applies.

- Are HSA contributions tax-deductible even if I don’t itemize deductions?

Yes, HSA contributions are an above-the-line deduction, which means you can deduct them from your taxable income even if you don’t itemize deductions on your tax return.

- Can I invest the funds in my HSA?

Yes, many HSAs allow you to invest the funds in various investment options like stocks, bonds, and mutual funds, potentially increasing your savings over time.

- Is there a deadline for using HSA funds?

There is no deadline for using HSA funds for qualified medical expenses. You can carry over unused funds from year to year, making it a valuable long-term savings tool.